Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Tokenomics Design: Access Models

In this second edition of our Token Utility content series, we’ll discuss how cryptocurrencies can be used in subscription or access models. We’ll also offer some food for thought on how and when they may be appropriate for your business. For more information on direct-sales models using cryptocurrency, check out our previous article on Payment Barriers.

The Evolution of Software Business Models

Photographers, filmmakers, and graphic designers were enraged when Adobe announced its switch from a direct-sales model to a subscription service in early 2013. Overnight, their users would change from owning Photoshop and other design suite platforms to “borrowing” access to these products via a cloud service.

Adobe’s aim to lower the financial barrier for most casual users would ultimately create more revenue from dedicated Photoshop pros using the software for their personal businesses. They had since seen record-breaking revenues and profits – double-digit YoY revenue improvements consecutively made every software company consider using subscription or “access models.” Even BMW now charges monthly subscription fees to new car owners to use their heated seats.

This example begs the question, when are subscription services appropriate, and how do they affect the end-user experience? Although there are some commonalities between fiat currency and cryptocurrency models, there are some major advantages offered by digital asset ecosystems. On the other hand, there are some potential drawbacks to be wary of.

Can Cryptocurrencies Work in Access Models?

Arcanum continues to witness more frequent discussions around business models tied to web3 economies. Something that was once a foreign concept to cryptocurrency investors a year ago is now the primary topic of discussion as VCs have become more careful about their investment strategies.

We’re still struggling to understand how some digital assets may actually translate to company ownership, claims on revenue generation, or exposure to underlying IP. Without any of these primary value drivers for a token, we’ve seen secondary value drivers in the form of direct sales or access models using the token.

Though not the most robust use cases for a decentralized digital asset, they do work to some extent by creating volume or temporary increases in asset demand.

Overall, we believe access models are not great long-term value drivers for digital assets. Still, the transparent, widely accessible nature of cryptocurrency allows for very interesting technical capabilities, so we’re careful to not dismiss the concept entirely.

What Are Cryptocurrency Access Models

‘Access models’ refer to the access to or use of a feature, product, asset distribution, etc. that is granted by retaining custody of a token.

Let’s give some practical examples:

- Hold any amount of our DAO tokens to participate in a governance vote for our protocol

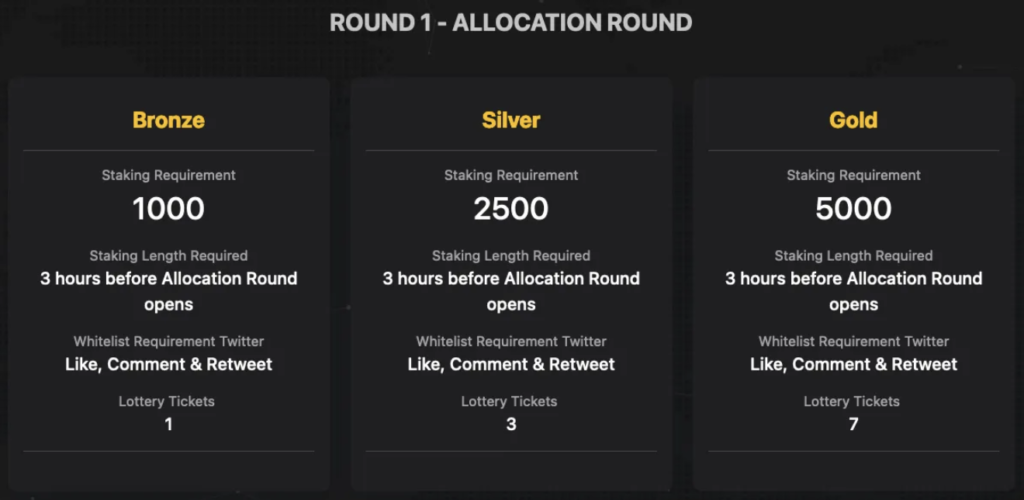

- Stake 1,000 of our launchpad tokens so you can be granted access to invest in this new startup.

- Hold our genesis NFT to be granted access to our exclusive trading community

Maybe you can find the theme with each of these three examples. They’re all pertaining to very niche elements of the cryptocurrency industry – concepts that are not widely adopted by businesses existing outside of crypto.

Arcanum believes digital assets can be introduced into a traditional business that is not targeted towards crypto degenerates, but the primary consideration needs to be the end-user. It’s important to understand if these access models are appropriate for your target customer and if that will help you gain more customers or push them away.

We’ll dive deeper into two real-world examples.

Steelmanning The Argument: Software Subscriptions That Work

An industry-leading online streaming platform hopes to foster a greater sense of brand loyalty and community involvement among its customers. They understand that one of the greatest benefits offered by cryptocurrency in their business model is easy transferability for loyalty points, rewards, or membership.

While some businesses may see this as an easy off-ramp for users to leave, others realize this can create stronger sentiment among positive PR and a new revenue stream on secondary market transaction volume. For this reason, the company launches an NFT-based yearly membership subscription plan.

Unique NFTs can be minted each year by a user paying $120 (subscription revenue). These users are able to gain accolades (asset modifiers for ERC-1155 standard) based on their content consumption, gain rewards points (fungible token supply) based on reviews they leave (community engagement), and participate in many other promotional programs (low-cap incentives).

Most importantly, users are able to sell their membership NFTs on the open market to others (Secondary Sales). They can even lend them out for a rental fee while they go on vacation or take a digital detox (NFT Lending). All of these transactions garner a 10% custody transfer fee for the company.

Breaking Down Argument: Software Subscriptions That Don’t

A company’s photo-editing software (Adobe again?) is a powerful piece of tech that intuitively allows editing to create professional-quality images. Their software subscription model uses cryptocurrency to access the online web app that allows cloud-based editing of photos only (Payment Barrier). The access can be granted by staking 100 of their native $PHOTO token in a decentralized wallet like Metamask (Volatile Payment Medium).

Functionally, this access model works. The technology is there and can be set up to do this exact thing. In fact, many web3 companies already do this.

What these companies fail to realize is, their business model is inherently flawed. This is not a subscription service. In fact, they are offering their product for a non-interest accruing loan they take from their customers. The value of the loan itself is difficult to quantify, considering the company’s gain is in the form of their token equity held and the increase in token price after the customer buys and stakes the token.

There is no guaranteed return on this open-market system since another token holder can capitalize on the price improvement and sell their tokens, bringing the value back down. So in this sense, the company is giving away its software possibly for free in this case.

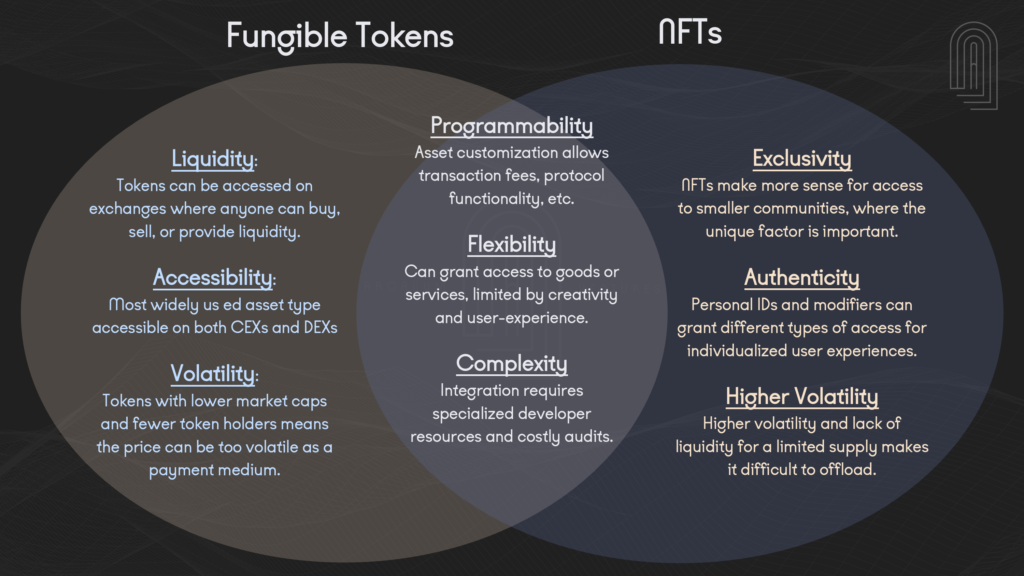

One major distinction in this model is the viability of selling fungible tokens versus non-fungible tokens. The DEX and corporate liquidation strategy will determine the capital generated for a fungible token in this model. A non-fungible token sale will result in direct-sales revenue for the company – though still not a subscription service model.

Which Digital Asset is Best for Subscriptions?

There are very distinct benefits of using a non-fungible token (NFT) versus a fungible token for access models. The tokenomics landscape is constantly evolving and best practices are not yet widely established. However, the main two considerations remain the same in all potential applications. One, no sacrifice to end-user experience. And Two, no added risk to corporate financial strategy. Here are some summarized pros and cons to consider for each asset class in your business model:

In general, Arcanum has been leaning towards these themes more recently in tokenomics advisory discussions:

- NFT ecosystem is meant to grant access and membership for product ecosystem where the community is important

- Fungible tokens supplement the user experience and offer streamlined rewards distributions, incentivized promotion participation, and additional flexibility in treasury management strategy.

The Summary of Cryptocurrency Access Models

There are major benefits to using cryptocurrency for access models. Liquidity and programmability are offered by fungible-token access models, while non-fungible token access models steer more towards authenticity and exclusivity.

It’s important to understand how using a cryptocurrency for access will impact the customer experience and impact the financial viability of your company. It may make sense to pursue direct-sales models in some situations where widespread governance is important to those that also value quickly entering and exiting the ecosystem.

NFT access models may make sense to companies looking to build on the user experience and foster brand loyalty and identity within the community.

If this content interests you, be sure to follow Arcanum Ventures on our social media channels. Reach out if you’re interested in working together to structure your company’s token economy.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

May 14, 2024

“Accessible, Transparent, Equitable”. Beyond the homepage and the navigation links, the ReformDAO whitepaper…

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…